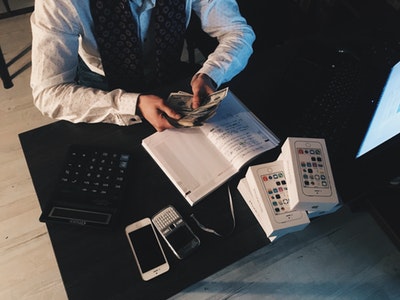

Do you need to worry about money when you run your business? The short answer is yes, and the long answer involves several ways that you can handle money effectively so that it never becomes a serious issue. For instance, you might want to think about hiring a business accountant. By hiring a business accountant, you should be able to keep track of your money and make sure that things don’t grow out of control financially. An accountant will keep an eye on your books and make sure that you are not overspending in certain areas.

There’s also the additional benefit of an accountant helping out during tax time. Tax can be a dangerous point for any company as it can result in underpayments. If this happens, the government will punish you with penalties, and these can be quite severe. As such, the extra cost of a skilled accountant could certainly be worth it. The good news is that an account can be hired online now and will access your account through a cloud server. Essentially, this means that you’ll never have to worry about meeting them or hiring an accountant full time. So, you will be saving money. Let’s look at some of the other ways you can handle money issues in your business.

Energy Efficient

You should work to keep your business as energy efficient as possible. One of the ways to do this would be by investing in a renewable energy source. There are lots of options here, though arguably the best would be solar power. You can install solar powers on the roof of your factory or office building. The installation cost can be quite expensive, but it will be worth it to make sure that you have a constant source of renewable energy for your business. Is this the only way to ensure that your business is energy efficient?

Actually, there are other possibilities that might be cheaper, such as upgrading tech. By upgrading your tech to more modern devices, you should certainly find that your business is cheaper to run. You’ll just be using less electricity on a daily basis. You won’t feel this on your finances straight away but you will at the end of the financial quarter.

Borrow And Buy

If you need to, you can consider borrowing money for your business. This can be a great option if you are looking to expand. Business expansions cost money and borrowing is typically the most cost-friendly possibility. It also doesn’t put you under pressure from investors who have funded your business across. According to workingcapital.co a great credit score and a health revenue stream will ensure you can borrow as much as you need for something like a business expansion.

Outsource

Lastly, you can think about outsourcing. Outsourcing can be a fantastic way to keep your spending under control because you won’t have to rely on hiring a full team of workers that tend to come with additional costs. Instead, you’ll pay for the service the outsource business provides and nothing else. You can learn more about the benefits of outsourcing on www.flatworldsolutions.com.

We hope this helps you if you’re worried about financial issues in your company.

No comments yet.