When entrepreneurs begin the process of starting up their SMEs their mentors, peers and friends tend to drum a simple message into them… “Keep your overhead costs under control”. It’s sound advice, it really is! It’s also easier said than done. There are so many myriad costs that come with starting up a business whether it’s a digital enterprise run from your home or dorm room in an hour or a robust outfit that requires a business premises or at the very least some office space. Of all those myriad costs, it’s hard for a neophyte to identify which will be essential to ensure long term growth and insulate your business from risk and which can be reduced or even cut out altogether. Knowing this is as simple as…

Know Your Fiscal Multipliers

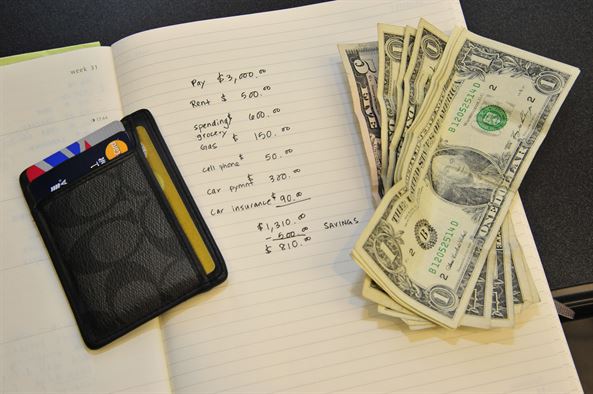

A fiscal multiplier represents the amount of economic activity that an overhead generates for the business proportionate to the cost. So if every $1 spent generates $5 of revenue, that cost’s fiscal multiplier is 5. For a cost to pay for itself the multiplier must be 1 and if it’s above 1 then it contributes to profit. That’s not to say that the only costs worth paying are those with a fiscal multiplier of 1 but it’s a good rule of thumb to keep in mind. Nonetheless, here are some overhead costs that are pretty much always worth paying to protect your business and ensure its organic growth.

Digital Marketing

There are so many digital marketing agencies out there that it can be daunting for a business neophyte. Thus, it might be tempting to try and take on all of your own marketing activities. Keep in mind, however, that it takes more than a way with words and some social media savvy to handle all of your business’ marketing. A good digital marketing agency will be able to work within your allotted budget and come up with a strategy for growth over 3 months, 6 months and 12 months. Since digital marketing costs have a typical fiscal multiplier of 5 they’re pretty much always a safe bet.

Insurance

Insurance does not have a fiscal multiplier and may not grow your business directly, but not having them can seriously impede your business’ growth. There are many kinds of insurance that a small to medium sized enterprise may need Employer’s Liability insurance, Property Insurance or Professional Liability Insurance but amongst the most important is Public Liability Insurance. Even if you run a home based business, if you’re dealing with third parties (i.e. the general public) you will need to buy public liability insurance from Qdos to protect your business. If a member of the public incurs an injury on your premises this insurance will protect you from having to pay damages which could cripple your growth by restricting your cash flow and do enormous damage to your reputation.

An accountant and bookkeeper

There are only two things that are certain in life and one of them is taxes. Left to your own devices, managing your tax can be a confusing and time consuming affair. An accountant and bookkeeper can properly manage your income and expenditure thereby ensuring that you only pay what is owed and that your records are presented in a way that will ensure transparency to your national tax authorities.

No comments yet.